Global Mobile Advertising

Strategy Analytics Platform

Report Annual Report: 2023 Global Mobile Game Advertising Trends

The global mobile gaming market experienced a significant upturn in 2023, rebounding from the advertising slump observed in the previous year. Data from AppGrowing indicates that there was a substantial year-over-year (YoY) increase of 26.5% in global game advertisement volume, signaling a resurgence in the high-investment, high-yield model that characterizes the gaming industry.

Delving into specific segments and publishers, the year 2023 witnessed a notable surge in developers and games that managed to distinguish themselves amidst fierce competition. A prime example is Century Games‘ “Whiteout Survival,” which has carved out a niche with its innovative blend of “icy survival theme” and “light SLG” elements. Another standout is Scopely‘s “MONOPOLY GO!,” a mobile game that has emerged as an unexpected contender in the casual gaming category for 2023, amassing over $1 billion in revenues within a mere seven months.

Beyond genre innovation, a number of publishers have overcome growth barriers by embracing the “Casual Non-Core Gameplay” strategy. Tap4Fun, for instance, has revitalized the three-year-old SLG title “Age of Apes” with the quirky and engaging non-core gameplay of “Monkey Eats Banana,” marking a new chapter in its growth trajectory.

To facilitate a comprehensive understanding of the shifting dynamics within the global mobile gaming market, AppGrowing has published the “2023 Global Mobile Game Advertising Trends” report. This insightful document provides a systematic review and analysis of global mobile game advertising trends, delving into category competition and regional disparities. It offers a multifaceted examination of the creative strategies employed by leading games, unveiling insights into live-action creatives, the appeal of casual non-core gameplay, and a variety of strategic formulas. AppGrowing’s report delivers a comprehensive assessment, spanning from data analysis to creative strategy, offering invaluable guidance for global digital marketers.

Click the button to download the full report “2023 Global Mobile Game Advertising Trends” for free.

The following are excerpts and interpretations of the report.

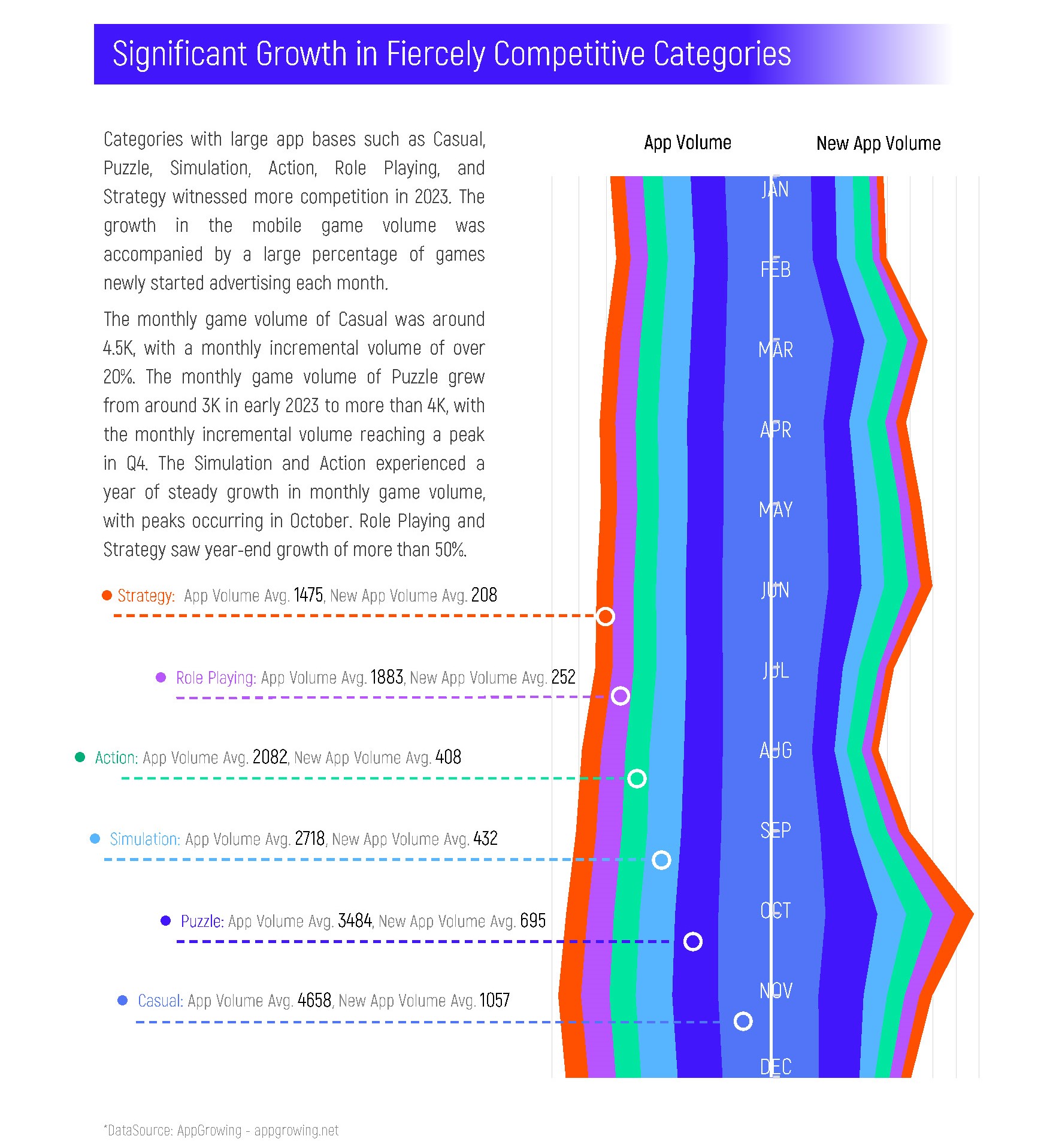

According to AppGrowing, the main categories with large app volume bases, such as Casual, Puzzle, Action, Simulation, Role Playing, and Strategy, saw more intense competition in 2023. While app volume continued to grow, the monthly newly released mobile game volume accounted for a large proportion of the total. Casual saw a monthly app volume of around 4,500, with an incremental share of more than 20%. Role Playing and Strategy ended the year with an app volume growth rate of more than 50%.

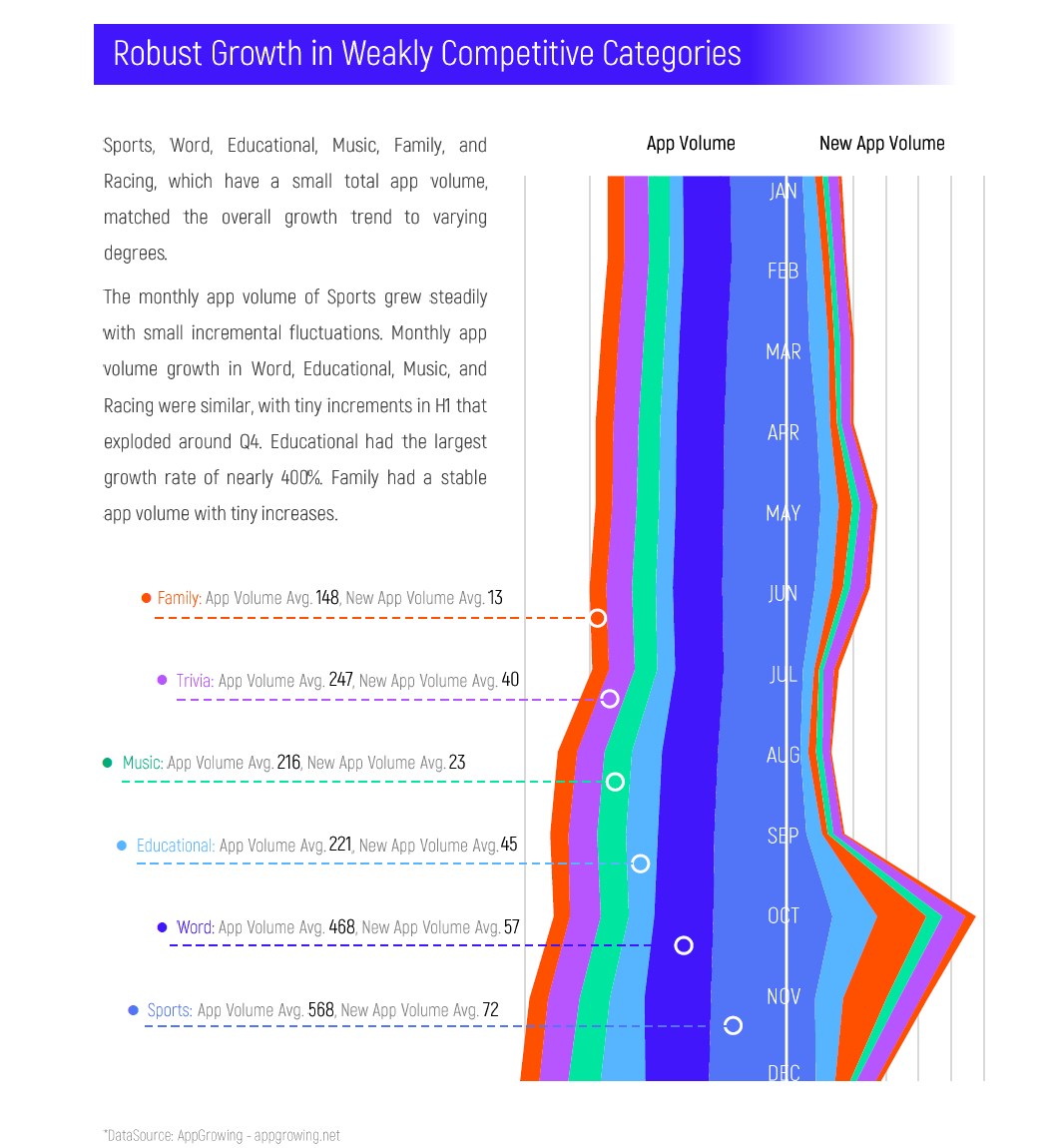

On the other hand, the “niche” categories of Sports, Word, Educational, Music, Family, and Racing, where the app volume is small, showed a clear overall growth trend. Mining niche gameplay and user base has become a breakthrough choice for many developers.

Specifically, the monthly app volume of Sports grew steadily. The growth of monthly app volume of Word, Educational, Music, and Racing categories is similar, all of which remained at the initial level with a small increase in H1, and suddenly grew massively in Q4. Among them, Educational had the largest growth rate, close to 400%.

On media, Meta Ads and Google Ads have the largest share of ad volume, with significant ad volume across categories. Besides, short video media such as TikTok and Kwai are becoming popular choices.

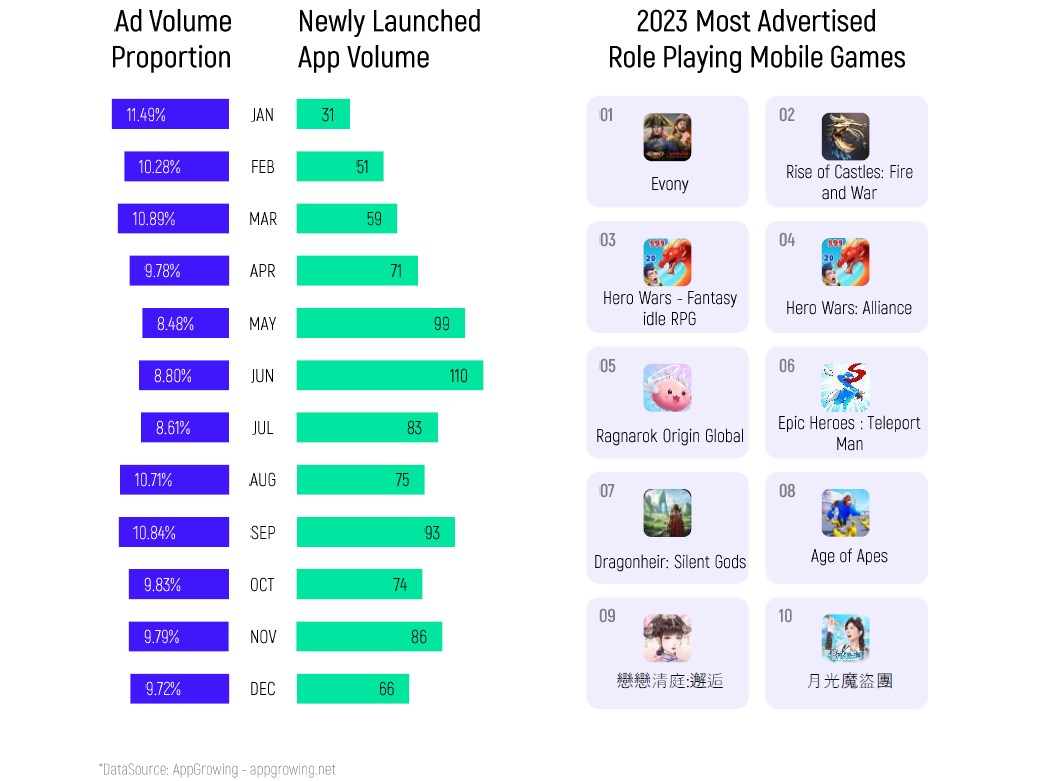

In “2023 Global Mobile Game Advertising Trends”, we conduct a comprehensive review of 9 major game categories. The report analyzes the advertising and creative trends of key categories from the perspective of monthly ad volume, newly released game app volume, and most advertised games charts. Below is a selection of Role Playing and Board analysis. For the entire content, please download the full report.

The overall trend in the ad volume share of Role Playing mobile games in 2023 was stable, remaining at 8%~11%. Role Playing is the category that most massively conducts pre-registration campaigns. In most months, the number of games from pre-registration to launch exceeds 60 and even reached 110 during the peak period from May to July.

Of the Top 10 Most Advertised Games, 7 are from Chinese publishers, with plenty of new games launching in 2023. Nuverse Games’ Dragonheir: Silent Gods and SPGame’s Moonlight Thieves showed the continued growth of Chinese developers. “Casual non-core gameplay” is widely applied in Role Playing. Hero Wars, Epic Heroes, and Age of Apes, all of which made the list, achieved new growth with this strategy.

Competition for Board mobile games was weak, and the share of ad volume was around 3%, reaching a peak of 3.91% in March. Entering Q4, Board mobile game advertising intensified, reaching a second peak of 3.65% in December.

On the list, there is no doubt that Scopely’s MONOPOLY GO! led the Board mobile game advertising market. Onet Puzzle, a match game from a Chinese developer, followed closely behind. Overall, the list is dominated by match and coloring games. There are two Board games on the list at the end.

“2023 Global Mobile Game Advertising Trends” revealed the advertising trends in 9 major markets: North America, Southeast Asia, Japan, Korea, Hong Kong & Taiwan of China, Latin America, Europe, South Asia, and the Middle East & North Africa. In addition to regional category analysis, AppGrowing further broke down ads by gameplay and art style based on “Game Tags”, providing insights into refined and comprehensive marketing trends and creative strategies.

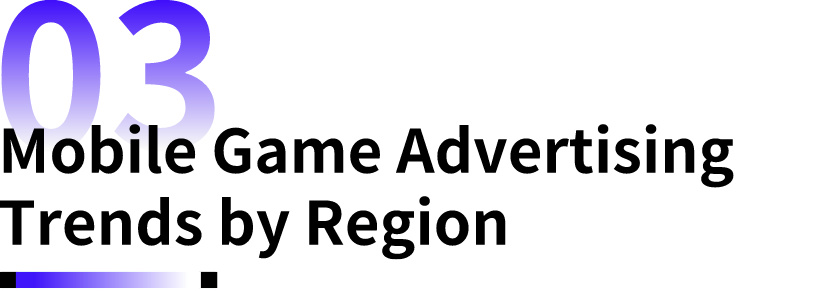

Take the Southeast Asian market as an example. In terms of ad volume share, Role Playing and Strategy were in the Top 5. Both of them ranked at the top for app volume, indicating that midcore and hardcore categories were the mainstay of advertising. The app volume share of Casual is much higher than others, but not much difference in ad volume share with hardcore ones. Casual game publishers mainly impact the market with quantity in Southeast Asia.

According to “Game Tags”, AppGrowing found management gameplay to be the popular Casual gameplay in the Southeast Asian market. Management games emphasize long-term strategy and satisfy the needs of players seeking relaxation and enjoyment.

On the other hand, several bullet storm games heavily advertised in Vietnam. The genre usually utilizes the intuitive excitement and exhilaration of game screens to attract players. This strategy may be a response to Southeast Asian players’ preference for fast-paced and exciting gameplay.

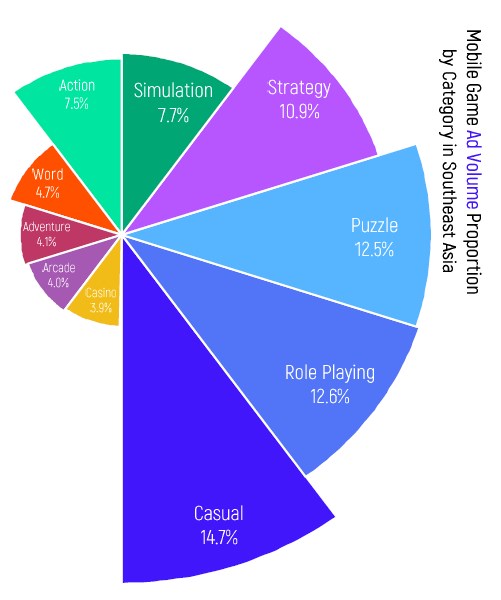

In addition, the Anime theme is also active in the Southeast Asian market due to the influence of Japanese and Korean culture, as reflected in Most Advertised Mobile Games. Among the Top 30 Most Advertised Mobile Games in Southeast Asia, there are a number of anime and IP-based games, such as Ragnarok Origin Global, Genshin Impact, and Sky Utopia.

Based on the category insights and hit games in 2023, “2023 Global Mobile Game Advertising Trends” has selected typical cases of 6 genres: Idle RPG, Action, Strategy, Board, Simulation and Hyper-Casual. We analyze the creative strategies of popular games from the perspectives of ad stage comparison, regional differences, and ad audience analysis.

We chose the Action mobile game Metal Slug: Awakening as a case analysis. Metal Slug: Awakening is a side-scrolling shooting mobile game licensed by SNK, developed by Tencent TiMi Studio, and published by VNG Games.

Metal Slug: Awakening began advertising on a small scale in June. In July, it started pre-registration, after which the ad volume gradually increased. It adjusted monthly ad volume and entered a stable period in Q4.

The ads for Metal Slug: Awakening focus on Southeast Asia and Hong Kong & Taiwan of China. As time goes by, the share of ad volume in the Southeast Asian market continues increasing. On the one hand, the game publisher VNG, as the head Internet company in Vietnam, is experienced in Southeast Asia. On the other hand, Metal Slug IP has a wider audience in Asia.

In terms of creative strategy, Metal Slug: Awakening focused on the IP and utilized local KOLs and game streamers to enhance its influence on local players.

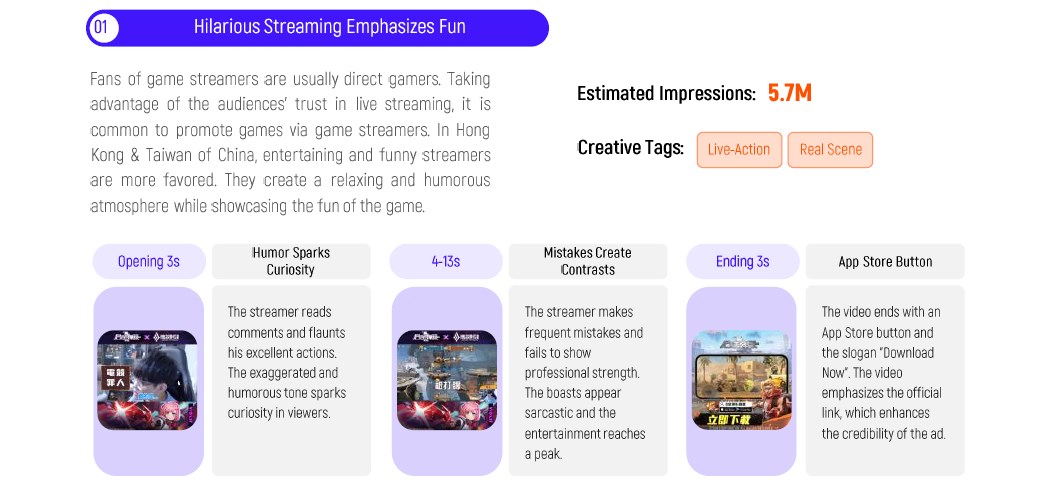

Fans of game streamers are usually potential gamers. Taking advantage of the audiences’ trust in live streaming, it is common to promote games via game streamers. In Hong Kong & Taiwan of China, entertaining and funny streamers are more favored. They create a relaxing and humorous atmosphere while showcasing the fun of the game.

AppGrowing has summarized the 2024 Global Marketing Calendar, Mobile Game Live-Action Creative Formulas and Case Analysis, and Casual Non-Core Gameplay Ad Creatives based on the past year’s global advertising trends. AppGrowing is committed to empowering global digital marketers to find the key to turning business from ashes to prosperity and to break through growth bottlenecks in the global mobile game market.

Click the button to download the full report “2023 Global Mobile Game Advertising Trends” for free.

Back to AppGrowing

Back to AppGrowing